This article was originally posted at Axel Standard, a platform for cloud accountants and SaaS applications.

In China, fapiaos are the most important document for tax reporting. They are the gold standard for a business’ taxable income – and for this reason, many accountants do their bookkeeping solely based on fapiaos. This method of accounting does not require the accountant to do much in terms of actually understanding the business since everything they need for bookkeeping is on the fapiao. This unknowingly creates many problems for businesses down the road.

Fapiao accounting refers to recognizing revenue and costs solely based on available fapiaos. Accountants do not conduct bookkeeping until they issue output fapiaos or receive input fapiaos – and from there they generate the required financial statements and calculate a business’ tax liability.

However, this simple method of accounting significantly limits an accountant’s ability to work inside a business and prevent some of the common financial mistakes managers make. These mistakes often result in the business paying tax early – hurting cash flow – and in many cases incorrectly calculating tax liability resulting in either overpaying or penalties for underpaying taxes. Most costly to businesses, however, is not having financial data which resembles the actual financial state of the business.

Fapiao accounting exists because it is the simplest way to meet tax compliance requirements in China. This article demonstrates the impact that the accounting method used to meet compliance requirement has on the tools and resources managers have to run their business and pinpoints the root cause of those problems.

Fapiao Accounting Produces Incorrect Financial Reports

An accurate finance report is a vital document which managers use to make important financial decisions. They need financial figures to help them understand their cash position and profitability. This gives them an accurate picture of their business and provides valuable information on which to base future management decisions. However, fapiao accounting can lead to a series of inaccuracies in financial reports rendering them useless for management.

When an accountant performs bookkeeping on the basis of fapiao, the figures on the financial reports are often distorted for a certain period. Financial reports show when fapiao’s were issued and not when the goods or services were delivered together with their associated costs. There’s a further delay in recognizing costs and expenses due to the inherent delay in when accountants receive input fapiaos from suppliers.

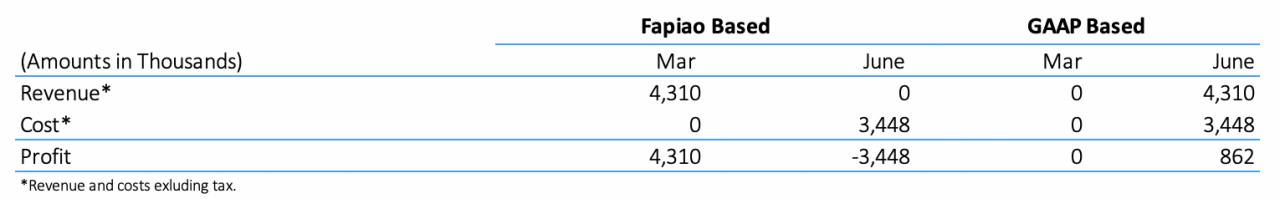

[Example 1]

When input fapiao’s are delayed, financial reports do not accurately reflect the profitability of a company for a given period.

For example, a trading company receives 5,000k payment in March and issues a VAT fapiao immediately. Products are delivered to customers two months later in June and 4,000k special input VAT fapiao is received in the same month from the supplier. The financial report shows overstated profits in March followed by losses in June due to a sharp increase in costs being recorded that month.

March profits are overstated by 4,310K because revenue is wrongly recognized based on the fapiao being issued and the true profitability across different periods becomes difficult to judge. Only when performing accounting based on PRC GAAP are true profits presented on the P&L.

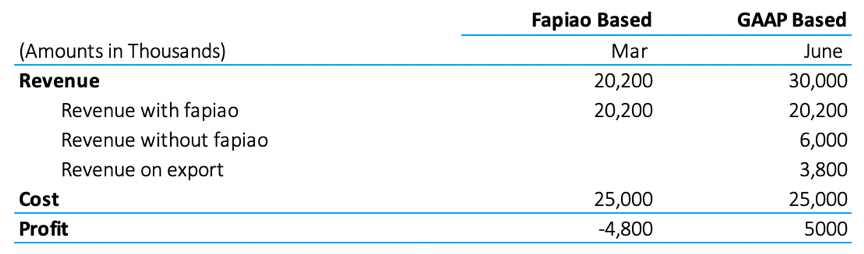

[Example 2]

In many cases, bookkeeping based on available fapiaos leads to transactions missing from financial reports.

For example, a business received 30,000K in sales in 2017, for which 26,200k were domestic sales and 3,800k were exports. From the domestic sales, 20,200k of the revenue included fapiao and 6,000k were sold without issuing fapiao. The costs of the goods sold was 25,000k. An accountant who only reports revenue based on available fapiaos will underreport revenue from revenue without fapiao and exports, equaling 9,800k and report a loss of 4,800k on the P&L as seen on the financial statement below.

There are many reasons a business might not issue a fapiao. Perhaps the customer didn’t need a fapiao or the sale was for export, in which case a fapiao is not required. However, in order for the balance sheet to accurately reflect bank balances, the accountant will book the revenue for which a fapiao was never issued under deposits, pre-payments, or other business liabilities on the balance sheet indefinetly.

Further Tax Issues With Fapiao Accounting

In addition to inaccurate financial reports, performing accounting on the basis of fapiao removes many of the tools accountants have to advise managers on how to best manage their business’ tax liability.

Managers might find their profits varying significantly between financial quarters, paying income tax early which needs to be claimed back, and paying large amounts of VAT compared to other businesses in the same industry.

Unfortunately, one of the most common tax management problems hurting small businesses is one which is most likely to affect those businesses who struggle to bring in a profit.

Early Tax Payment

For small businesses who perform bookkeeping on the basis of fapiao, as opposed to on the basis of ACCRUAL according to PRC GAAP, a spike in revenue when a company issues a large fapiao for goods or services might cause it to be significantly more profitable over a single financial month/quarter than over the financial year.

If the profits of one financial quarter are offset by losses in another during a financial year, the company must claim back the corporate income tax prepaid quarterly in next year. This process can be time-consuming and requires the business to provide proof to the tax bureau that the business did lose money over the financial year. In many cases, the tax authorities will conduct a full-scope tax audit before refunding quarterly prepaid tax.

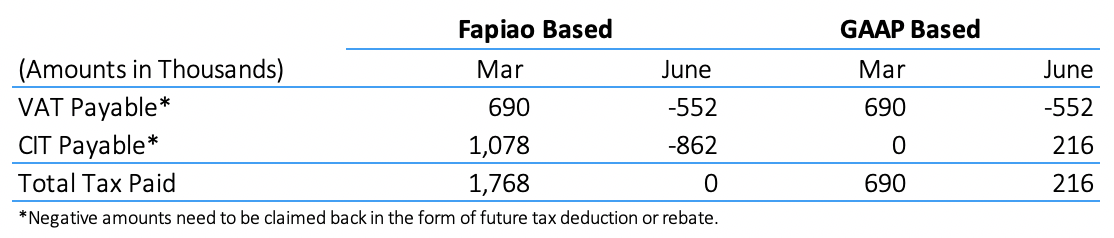

[Example 1]

For the previously mentioned example 1, when the business issued 5,000k fapiao for a sale without a corresponding input fapiao, its total tax liability equals 1,767k in March. When the costs are booked in June, the true tax liability becomes 353k and the 1,414k difference must be claimed back by the business in the form of future tax deductions or refunds.

For VAT:

Output VAT is always recognized upon issuing a fapiao. Even when accounting on the basis of GAAP, output VAT must be paid regardless of whether input VAT fapiao has been received. Overpaid VAT can be deducted from future VAT payments.

For CIT:

The company has to pay 1,078K of CIT for Q1 2017, while its true CIT liability is only 216K in Q2 2017 if bookkeeping and fapiao issuance are done according to PRC GAAP.

If the business reports a tax loss for 2017, the business would need to apply for a CIT refund in 2018 for the overpaid CIT for Q1 2017. This often requires the tax authorities to conduct a full scope tax audit to prove the business indeed incurred losses before refunding CIT.

Underreporting Tax Liability

In example 2 in the previous section, the business underreported its revenue by 9,200k resulting in a net loss of 4,800k. For a standard domestic product sale, the tax shortage of the unreported revenue will equal ~41% (16% VAT + 25% CIT) of the revenue.

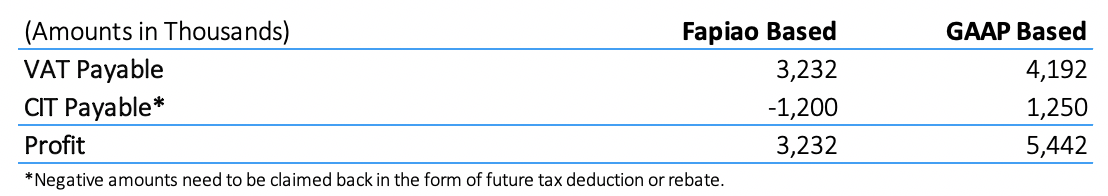

[Example 2]

The company total tax shortage resulting from the underreported revenue (equal to 9,800k) from example 2 equals 2,210K for the 2017 financial year.

Below is the tax liability associated with the P&L ;

As of mid-2016, the tax authorities employed new legislation to monitor the revenue and expenses flowing through a business’ bank accounts and compare them with their declared tax liability. Any unreported revenue, for example, the revenue booked under deposits, pre-payments, or other business liabilities on the balance sheet, will invite the tax authorities for a full-scope tax audit of the business.

Such tax shortage will cause penalty from the tax bureau as follow:

– 0.5-5 times of tax shortage, in addition to the amount of tax shortage. (based on tax amount and discretion of tax authority)

– 0.05% of tax overdue per day

– Imprisonment in serious cases

When an accountant performs bookkeeping solely based on the availability of fapiaos, they rely on manager to report to them the revenue for which fapiaos are not available.

Conclusions

Some of the problems business’ facing as a result of fapiao accounting, such as the lack of accurate financial data, can easily be diagnosed by managers. Others, such as those affecting the business’ cash flow and tax liability, are not as easily traced back to the accounting method.

Establishing whether a business’ outside accountant is capable of working closely with the business and advising managers on the accounting implications of their decisions is an integral part of solving such business problems.

It sounds counterintuitive to transition away from accounting on the basis of what we called the “gold standard for a business’ tax liability”. But it’s important that as business’ grow, they move beyond simply compliance. This means taking steps to involve your accountant in your transactions as they occur and transition to bookkeeping on the basis of ACCRUAL according to the PRC GAAP.

Speak to your accountant to begin accruing your business transactions and ask about an appropriate tax strategy. This is often enough to start the discussion about improving your finances and making sure your business stays on track.

Notes:

PRC GAAP – the Peoples Republic of China, Generally Accepted Accounting Principles

ACCRUAL – Accounting method that records revenues and expenses when goods or services are actually delivered, regardless of when cash and fapiao are exchanged.