One of the compliance contemplations of operating a business in China is the Social Security responsibilities relevant to employment. The Labour Law carried out in 1994 and Labour Contract Law in 1998 established the main framework of the Scheme. Social security consists of pension, work-related injury, unemployment insurance, medical insurance and housing fund. The previous maternity insurance now comes under medical insurance.

The exact percentages of each category vary at the discretion of the Social Security Bureau and Housing Fund Management Centre in each city. To make the contribution of social insurance, employers need to register new employees with the corresponding bureaus. Employees and employers are both required to contribute to the social security and housing fund account of the employees, albeit foreign employees are spared from the housing fund responsibility.

There has been no confusion for companies to handle social security contributions for Chinese employees – It has always been mandatory for Chinese individuals to make a joint contribution to their social security account with their employers, whereas the practice for foreign individuals was not unified across China.

The unaddressed inconsistency since 2009 between Shanghai and National regulation regarding social security contribution for foreign employees had created an opportunity for interpretation. In most cases, the employer would naturally opt-out of the contribution for their foreign staff. The notice issued by the Shanghai Municipal Bureau of Resources and Social Security was extended in 2016. As the previous social security announcement for foreign nationals expired on 15th August in Shanghai, it leaves ex-pats no room for discretion but to comply by contributing to their social security account.

Shanghai Social Security Reference Table

| Chinese Nationals | Foreign Residents | ||||

| Individual | Employer | Individual | Employer | ||

| Pension | 8% | 16% | 8% | 16% | |

| Work-related Injury | N/A | 0.16% – 1.52% | N/A | 0.16% – 1.52% | |

| Unemployment Insurance | 0.5% | 0.5% | 0.5% | 0.5% | |

| Medical Insurance | 2% | 10.5%

(including 1% from maternity insurance) |

2% | 10.5%

(including 1% from maternity insurance) |

|

| Maternity Insurance

(being included under Medical Insurance as of 2020) |

N/A | N/A | N/A | N/A | |

| Housing Fund

(not required for expats) |

5 – 7% | 5 – 7% | N/A | N/A | |

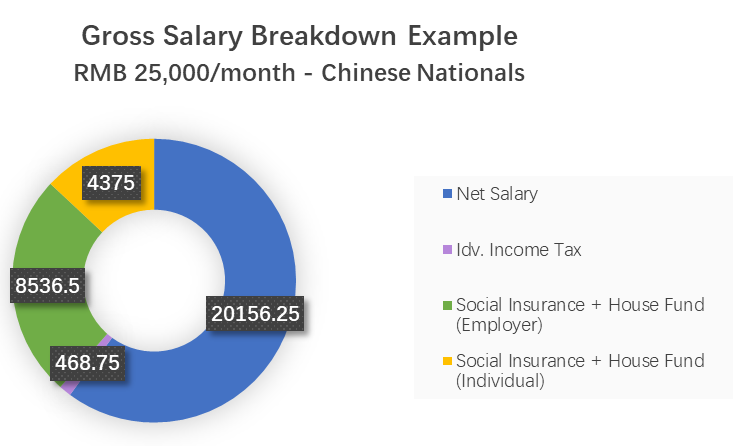

The above pie chart provides an example of the composition of gross salary RMB 25,000/month, assuming the housing fund percentage is 7% and work-injury insurance 0.25%. Housing fund percentage is determined by the employer whereas work-injury insurance is decided by the Bureau.

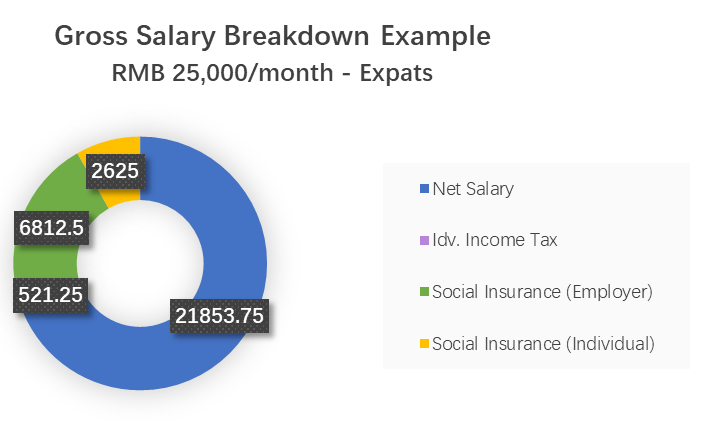

Housing fund contribution is not required for ex-pats. Therefore, the composition of salary package will alter slightly as per below.

With the reinforcement of social security contribution for foreign employees, the cost of employment is higher otherwise, leaving it almost identical to hiring local staff. With more foreign employees working and retiring in China, the social insurance scheme provides security for the individuals and order for the government.

Under the circumstances of the employee leaving the current city or China, the personal contribution to the social security account is available for withdrawal. The employer’s contribution could be transferred to the destination city (possible between some specific cities) or deemed to be forgone.

Compliance is one of the baselines for success in operating a business in China. “Integrity, efficiency, clarity” is the value proposition of STAR Accounting & Consulting. With 15 years of servicing foreign clients from around the globe, understanding profoundly what our clients are looking for, we thrive on providing advice with clients’ best interests at heart. Should you have any further questions on employment, social security, payroll or other aspects of your business, please do not hesitate to contact Nancy Chen at nancy@star-acc.com.